Canada Goose Holdings (GOOS)·Q3 2026 Earnings Summary

Canada Goose Revenue Beats But EPS Miss Sends Shares Down 21% After Hours

February 5, 2026 · by Fintool AI Agent

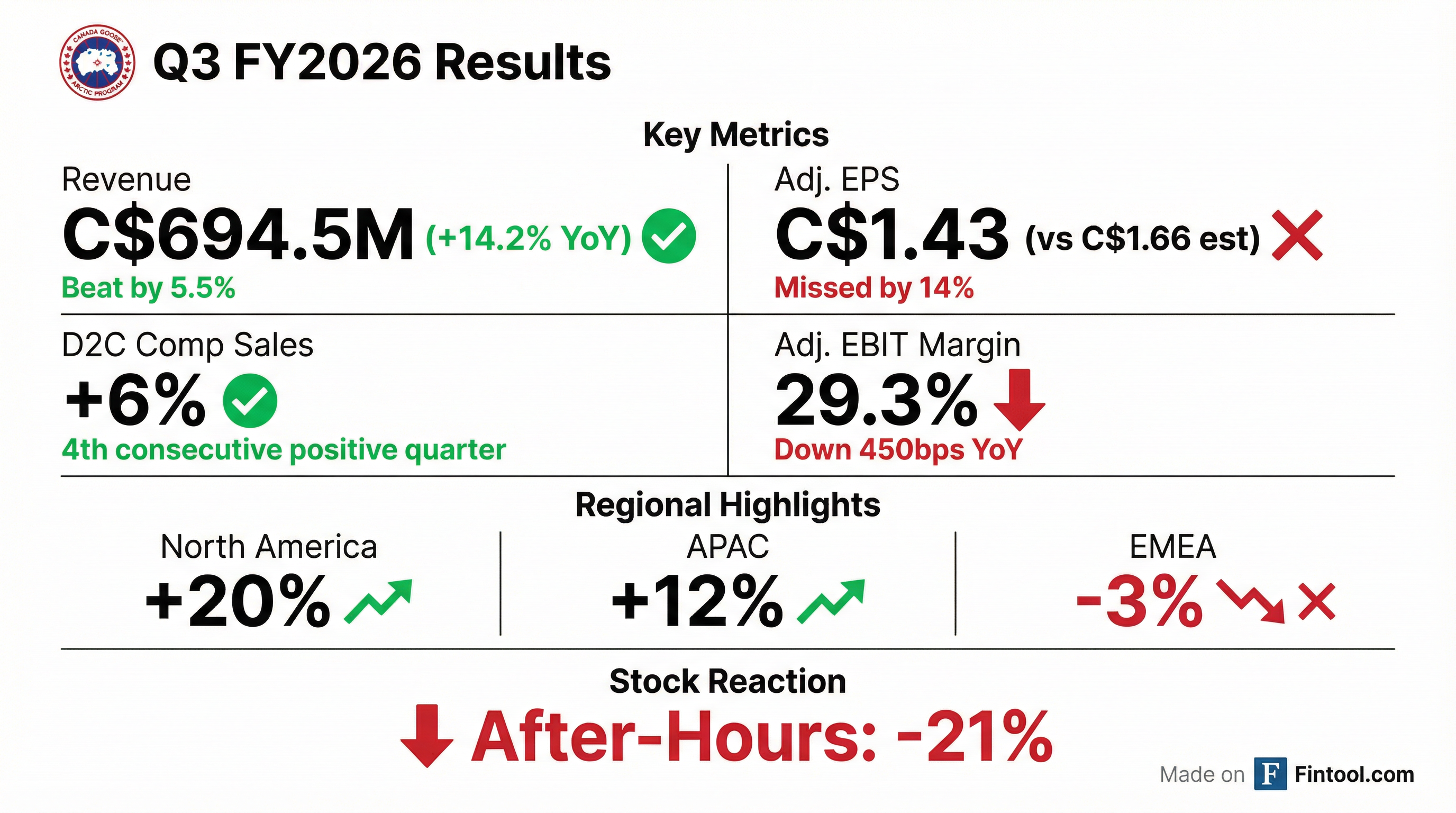

Canada Goose Holdings (GOOS) delivered a mixed Q3 FY2026, beating revenue expectations by 5.5% but missing EPS by 14% as margin pressure from strategic investments overshadowed strong top-line momentum. The stock traded up 4.3% during the regular session to $13.22 but plunged approximately 21% in after-hours trading to $10.44 as investors digested the margin deterioration.

Did Canada Goose Beat Earnings?

Revenue: Beat by 5.5% — C$694.5M actual vs. C$658.5M consensus (+14.2% YoY, +13% constant currency)

Adjusted EPS: Missed by 13.9% — C$1.43 actual vs. C$1.66 consensus (down from C$1.51 YoY)

The revenue beat reflects the fourth consecutive quarter of positive D2C comparable sales and strong wholesale performance, driven by expanded product assortment and elevated marketing investments. However, these same investments—combined with labor productivity issues and discrete items—drove the EPS miss.

What Drove the Margin Compression?

Adjusted EBIT margin contracted 450 basis points year-over-year to 29.3%, the most significant squeeze in recent quarters. Management attributed this to three main factors:

Discrete Items (~C$24M impact):

- C$15M one-time bad debt provision related to a U.S. wholesale partner

- C$9M FX gain in prior year that did not recur

Strategic Investments (~C$13M):

- Increased marketing spend for brand heat initiatives

- Upper funnel investment to reposition brand visibility

Store Labor Productivity:

- Labor levels maintained higher than demand required

- SG&A grew ahead of revenue growth

CEO Dani Reiss was direct: "While we are pleased with our top-line performance and our brand momentum, our adjusted EBIT margin contracted meaningfully... We did not strike the balance right with margin."

How Did the Stock React?

The stock's bifurcated reaction tells the story of investor confusion:

- Pre-market: +1.5% on headline revenue beat

- Regular session: +4.3% to $13.22 as traders processed strong D2C momentum

- After hours: Approximately -21% to $10.44 as the 450bp margin miss and EPS shortfall dominated sentiment

The magnitude of the after-hours decline suggests the market was pricing in margin expansion given the strong revenue trajectory—instead getting contraction. Analyst price targets were already cautious at $11.90 ahead of earnings.

What Changed From Last Quarter?

Improved:

- D2C comps accelerated to +6% from +1% in Q2

- Wholesale returned to positive growth (+14% vs. -14% in Q2)

- Inventory turns improved 16% YoY to 1.1x

- Net debt reduced to C$413M from C$546M YoY

Deteriorated:

- EBIT margin contraction widened (450bps vs. 650bps in Q2)

- EMEA continued declining (-3% vs. -6% in Q2)

- Store labor productivity issues emerged as a theme

The company's four consecutive quarters of positive comparable sales growth provides evidence that brand investments are working. However, the inability to translate top-line strength into margin expansion is the key concern.

Channel & Regional Performance

By Channel

D2C comparable sales rose 6%, marking the fourth consecutive quarter of positive comps—a key milestone the company highlighted as proof its strategic investments are paying off. Store conversion has trended higher for four consecutive quarters, led by APAC and North America.

By Region

China was called out as "one of our strongest markets" with brand desire exceeding competitive benchmarks. The Lunar New Year shift into Q4 should provide a tailwind for the next quarter.

What Did Management Guide?

Management did not provide explicit numerical guidance but outlined a clear path to margin expansion in FY2027 through three focus areas:

1. Operating Efficiency

- Store labor model changes implemented in APAC (mid-December) and rolled out globally in January

- Marketing efficiency improvements to reduce marketing as % of revenue

- Continued corporate headcount discipline

2. Retail Network Optimization

- Full portfolio review underway

- Optimization initiatives expected in FY2027

- New stores will still open but with sharper economics focus

3. Gross Margin Levers

- Price increases planned for early FY2027

- Sourcing and operational improvements ongoing

- Vertical integration remains a structural advantage

Q4 Commentary: January performance remains strong, and Lunar New Year shopping should benefit from later timing vs. last year. Q4 marketing spend expected lower as a percentage of revenue than last year.

Key Management Quotes

On profitability priority:

"Delivering strong and sustainable profitability is my top priority for our organization." — CEO Dani Reiss

On margin commitment:

"I am committed to returning Canada Goose to margin expansion, and I'm confident in our ability to do so in fiscal 2027." — CEO Dani Reiss

On the investment/margin tradeoff:

"Margins this quarter reflected deliberate choices we made to expand product relevance and fuel brand momentum... These actions will position us to expand margins in the years ahead." — CEO Dani Reiss

On China brand strength:

"When you look at the investment that we've been making for a number of years, what we look at when we see... the competitive set, how we're doing relative to that, we are seeing demand very strong." — President Carrie Baker

Product Strategy: Year-Round Relevance Working

The company's push to expand beyond heavyweight parkas is showing results:

- Revenue from newness doubled YoY — new styles, fabrics (EnduraLuxe, wool), and colorways all performed

- Lighter weight styles drove growth while down-filled outerwear remained a market leader

- Snow Goose collection (designed by Haider Ackermann) serving as brand halo

- All major non-parka categories growing — apparel, everyday wear, rain categories

However, this product mix shift is creating gross margin pressure as non-down-filled outerwear carries lower margins than the core parka business.

Risks & Concerns

Near-Term:

- After-hours selloff may create negative momentum heading into Q4

- EMEA remains a problem with no clear catalyst for improvement

- Bad debt provision raises questions about wholesale partner health

- Store labor productivity issues suggest operational execution gaps

Medium-Term:

- Product mix shift toward lower-margin categories could structurally pressure gross margin

- Marketing investment levels may need to remain elevated to sustain brand heat

- Management credibility on margin expansion depends on FY2027 execution

What Management Avoided:

- No specific FY2027 margin targets provided

- Limited color on which US wholesale partner required the bad debt provision

- No discussion of potential tariff impacts despite being a Canadian manufacturer

Q&A Highlights

On D2C traffic vs. conversion (Oliver Chen, TD Cowen): Management confirmed global store conversion has trended higher for four consecutive quarters, led by APAC and North America. The labor investment was specifically designed to improve service quality and conversion. E-commerce benefited from "strong traffic trends throughout the quarter."

On margin recovery path (Jonathan Komp, Baird): COO Beth Clymer outlined a three-step margin journey: (1) right-size corporate costs (achieved), (2) drive sustained positive comps (achieved with 4 straight quarters), (3) leverage that strength for margin improvement (underway). She noted investments this year were "medium and long-term payback" which gives confidence they can moderate going forward.

On incremental margin contribution (Brooke Roach, Goldman Sachs): Management emphasized that marketing investments (upper funnel, brand positioning) and store labor investments (training ahead of peak) were designed to pay back over multiple years. This structure allows the company to reduce incremental spending while maintaining effectiveness.

Forward Catalysts

Near-Term (Q4 FY26):

- Lunar New Year results (later timing = benefit)

- January momentum continuation

- Reduced marketing spend as % of revenue

FY2027:

- Price increases in early fiscal year

- Store labor model efficiency realization

- Retail network optimization

- Marketing efficiency improvements

- Haider Ackermann design influence expanding

Key Dates:

- Q4 FY26 Earnings: Expected mid-May 2026

- FY2027 Guidance: Typically provided with Q4 results

This analysis was generated by Fintool AI Agent on February 5, 2026, following Canada Goose's Q3 FY2026 earnings release.